World banking is at a turning level. As fee volumes develop, digital channels broaden, and monetary crime turns into extra refined, conventional transaction monitoring programs are being pushed past their limits.

Rule-based engines – as soon as the spine of fraud detection and compliance – are fighting false positives, delayed responses, and an incapability to adapt shortly to new threats.

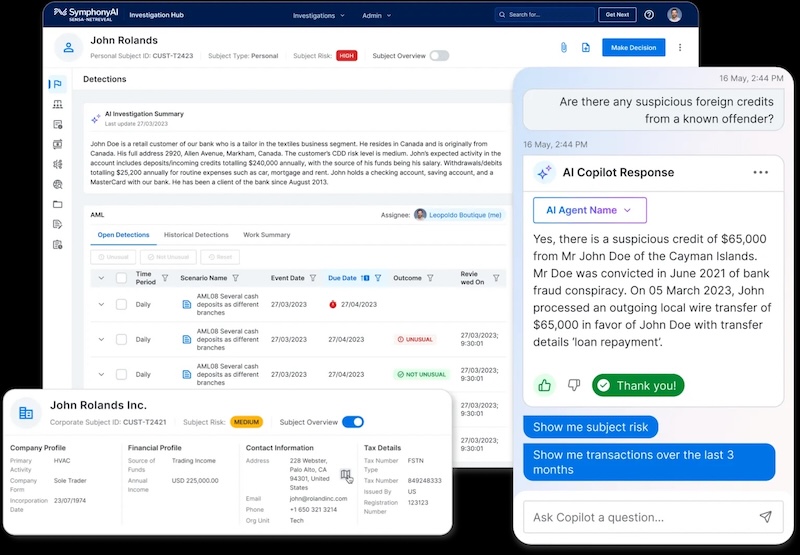

Synthetic intelligence (AI) is reshaping this panorama. AI-driven transaction monitoring is not a theoretical improve; it’s quick changing into a foundational functionality for banks in search of to handle fraud and danger successfully in a posh, real-time monetary ecosystem.

By studying patterns, adapting to vary, and working at scale, AI is redefining how world banks shield prospects, meet regulatory expectations, and keep belief.

Why Conventional Transaction Monitoring Is Falling Brief

For many years, banks have relied on static guidelines to flag suspicious transactions. These programs work by making use of predefined thresholds – transaction measurement, frequency, geography, or counterparties – to establish potential danger. Whereas easy, this strategy has a number of structural weaknesses.

The False Constructive Downside

Rule-based programs are likely to err on the facet of warning, producing massive volumes of alerts. Compliance groups should manually evaluation many transactions that in the end show reputable. This not solely will increase operational prices but additionally slows response instances to real threats.

Restricted Adaptability

Monetary crime evolves shortly. Fraudsters consistently take a look at system boundaries, exploit new fee strategies, and reap the benefits of world inconsistencies in regulation. Static guidelines require frequent guide updates, leaving banks perpetually one step behind.

Fragmented Danger Visibility

Conventional monitoring instruments usually function in silos, specializing in particular person transactions relatively than holistic buyer habits. This makes it troublesome to detect delicate, multi-stage schemes resembling cash laundering networks or account takeover campaigns.

These challenges have pushed banks to search for extra adaptive, clever options.

What Makes AI-Pushed Transaction Monitoring Completely different

AI-powered programs strategy transaction monitoring from a basically totally different perspective. As an alternative of relying solely on mounted guidelines, they analyze massive volumes of information to study what “regular” habits seems to be like – and establish deviations in actual time.

Machine Studying and Behavioral Evaluation

Machine studying fashions look at historic transaction knowledge to grasp buyer habits patterns. This consists of spending habits, transaction timing, geolocation developments, system utilization, and peer comparisons. When habits deviates meaningfully from established norms, the system can flag it for evaluation.

Importantly, these fashions enhance over time. As investigators resolve alerts, the system learns from outcomes, refining its danger assessments and decreasing pointless flags.

Actual-Time Determination-Making

AI-driven monitoring operates at machine pace. Transactions may be assessed as they happen, enabling banks to dam, problem, or escalate suspicious exercise earlier than funds depart the system. That is significantly essential for fast funds and cross-border transfers, the place delays can imply irreversible losses.

Contextual Danger Scoring

Quite than producing binary “suspicious or not” outcomes, AI programs assign dynamic danger scores primarily based on a number of variables. This permits compliance groups to prioritize the highest-risk circumstances and allocate sources extra successfully.

Strengthening AML and KYC By way of AI

Transaction monitoring doesn’t exist in isolation. It’s a core pillar of broader anti-money laundering (AML) and know-your-customer (KYC) frameworks. AI enhances these processes by connecting id, habits, and transaction knowledge right into a unified danger view.

Trendy banks more and more consider options alongside different compliance applied sciences, together with buyer due diligence platforms and onboarding instruments. Because of this, establishments usually search for built-in ecosystems that mix monitoring, screening, and id verification – continuously benchmarking suppliers considered the best AML KYC software to make sure consistency and scalability throughout compliance operations.

By aligning transaction monitoring with AI-driven AML and KYC capabilities, banks acquire a extra correct understanding of buyer danger over your complete lifecycle.

Regulatory Expectations and Business Alignment

Regulators all over the world aren’t solely accepting AI-driven monitoring – they’re more and more anticipating it. Supervisory our bodies in main monetary facilities emphasize risk-based approaches, steady monitoring, and explainability in compliance applications.

Transparency and Explainability

One concern usually raised about AI is the “black field” drawback. In response, trendy transaction monitoring options prioritize explainable AI, the place danger selections may be traced again to contributing components. This transparency is crucial for regulatory audits, inside governance, and buyer belief.

Alignment With World Requirements

Worldwide our bodies such because the Monetary Motion Activity Power (FATF) encourage using superior analytics to fight monetary crime extra successfully. Whereas they don’t mandate particular applied sciences, there’s a broad consensus that AI, when correctly ruled, enhances the effectiveness of AML and fraud applications.

Banks that proactively undertake AI-driven monitoring are sometimes higher positioned throughout regulatory examinations, as they will exhibit steady enchancment and proactive danger administration.

Operational Advantages Past Compliance

Whereas compliance is a main driver, AI-driven transaction monitoring delivers worth throughout the group.

Lowered Prices and Improved Effectivity

By reducing false positives, AI reduces guide evaluation workloads. Compliance groups can deal with complicated investigations relatively than routine alerts, enhancing each morale and productiveness.

Enhanced Buyer Expertise

Fewer pointless transaction blocks and account freezes imply much less friction for reputable prospects. When interventions are required, they’re extra focused and well timed, preserving belief whereas sustaining safety.

Strategic Danger Insights

AI programs generate wealthy analytics that assist banks perceive rising dangers, buyer developments, and operational vulnerabilities. These insights inform broader danger methods, product design, and market growth selections.

Challenges and Accountable Implementation

Regardless of its benefits, AI-driven transaction monitoring will not be a plug-and-play answer. Profitable adoption requires cautious planning and governance.

AI fashions are solely nearly as good as the information they devour. Banks should spend money on clear, well-integrated knowledge sources throughout channels, areas, and legacy programs.

Unchecked algorithms can inadvertently reinforce bias or unfair remedy. Main establishments set up oversight frameworks, common mannequin validation, and cross-functional evaluation to make sure equity and accountability.

AI augments, relatively than replaces, human judgment. Expert compliance professionals stay essential for complicated investigations, regulatory interpretation, and strategic decision-making.

Conclusion

AI-driven transaction monitoring represents a shift from reactive compliance to proactive danger intelligence. As monetary crime grows extra complicated and regulators demand increased requirements, banks can not depend on outdated instruments.

The long run factors towards adaptive programs that study repeatedly, function in actual time, and combine seamlessly with broader compliance and danger frameworks. Establishments that make investments early – not simply in expertise, however in governance, expertise, and knowledge – will probably be higher geared up to guard prospects, meet regulatory expectations, and compete in a digital-first world economic system.

On this sense, AI will not be merely enhancing transaction monitoring; it’s redefining the very basis of fraud and danger administration in trendy banking.